reit dividend tax canada

The 293 billion REIT is the lone real estate stock in the cure sector. Slate Office REITs second-quarter revenue surged 187 year over year and net operating income surged 178.

REITs in Canada are an approximately 80 Billion market cap industry.

. Investor owns 5 or less of a. The indexs holdings are based on the REITs risk-adjusted dividend yield. The majority of REIT dividends are taxed as ordinary income up to the maximum rate of 37 returning to 396 in 2026 plus a separate 38 surtax on investment income.

Fundrise just delivered its 21st consecutive positive quarter. 15 tax rate if shareholder owns more than 50 of the REITs voting stock. The ROC will reduce the ACB to -100 so you will receive an immediate capital gain of 100.

When a REIT makes a capital gains distribution 20 maximum tax rate plus the 38 surtax or a return of capital distribution. When a REIT. Jamaica and no more than 25 of the REITs income consists of dividends and interest.

The ETFs dividend yield is 3. Consider this example. This means that dividend income will be taxed at a lower rate than the same amount of interest income.

My approach is to stick with the dividend growers such as. Granite REIT has a diversified yet balanced geographical presence in Canada 26 of. Taking into account the 20 deduction the highest effective tax rate on.

The ACB will then be adjusted to zero. Your ACB is 200 and the REIT pays a distribution of 800 consisting of 100 other income 400 capital gain and 300 ROC. Taking into account the 20 deduction the highest effective tax rate on Qualified REIT Dividends is typically 296.

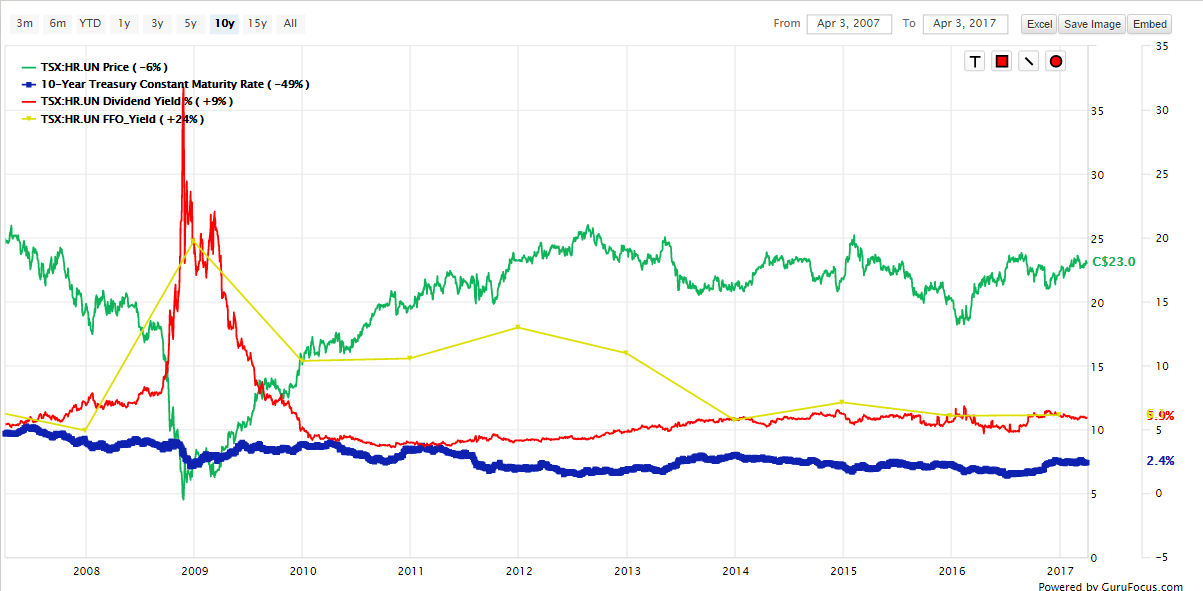

The above is a view of the large REITs in Canada grouped by industry. In the case of Bulgaria Canada and the Netherlands 0 also only so long as not from carrying on a. 20 tax rate if shareholder owns at least 10 of the REITs voting stock.

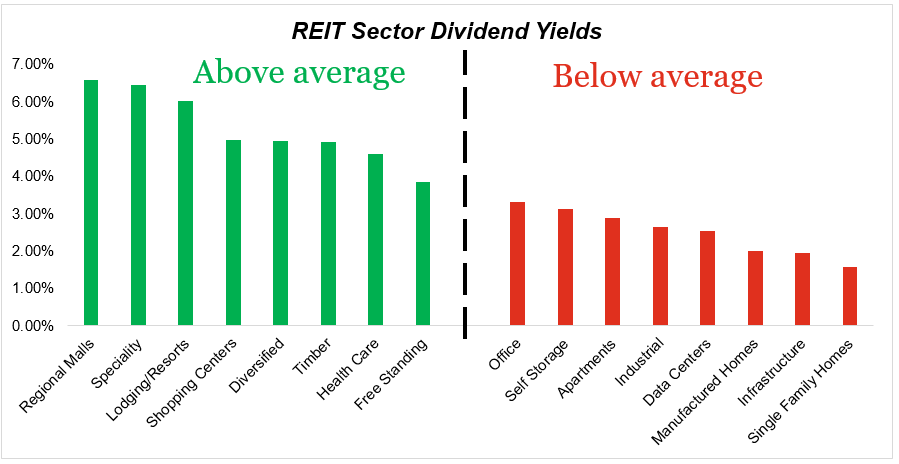

Magna accounts for 60 of Granites total revenues. Secondly you sacrifice dividend yield. This index tracks 19 Canadian REITs that pay dividends and rebalances twice a year in January and July.

The tax rates in the chart apply to REIT capital gain distributions so long as the non-US. 28 rows While US. The higher the REITs dividend yield the more weight is placed on that REIT.

Learn ways dividends can help generate income in this free retirement investment guide. This means dividends from REITs are typically considered as ineligible dividends and thus are not eligible for the Dividend Tax Credit. Investors in the highest tax bracket pay tax of 39 on dividends compared to about 53 on interest income.

Over the past three years Invesco REIT ETF returned 24. It owns and operates a portfolio of healthcare real estate infrastructure such as medical office buildings hospitals and. Considering you could buy all 6 stocks through a brokerage like Qtrade for 30 in commission this is a significant jump.

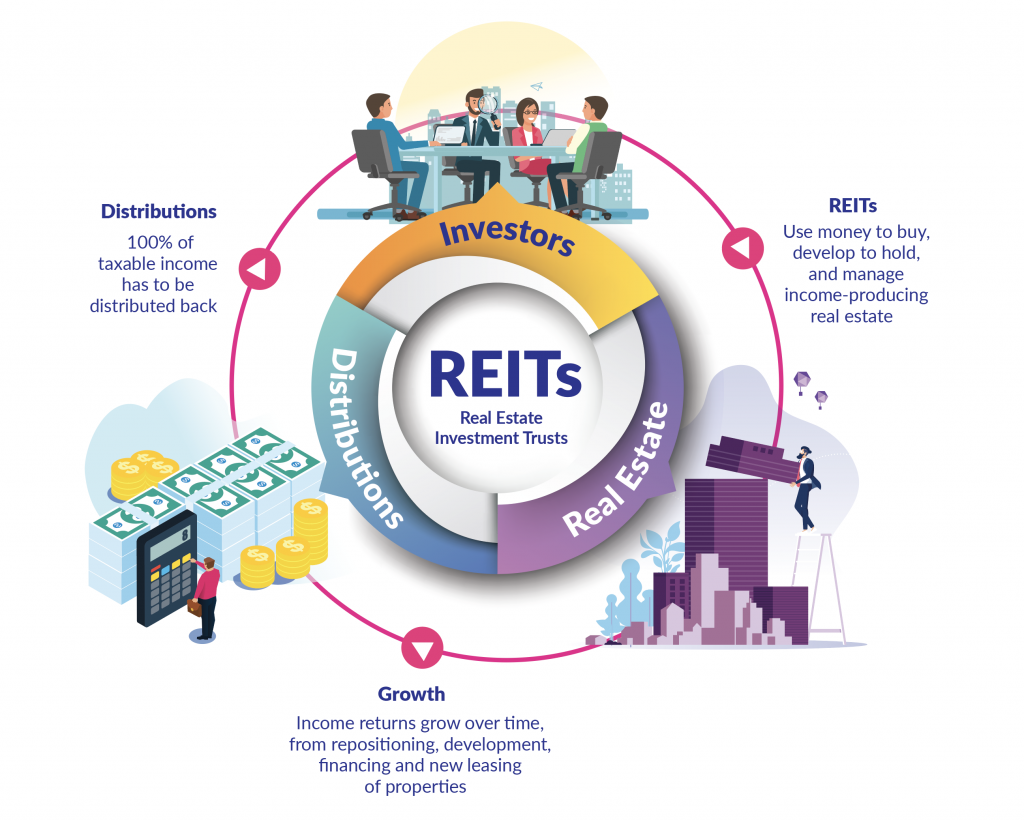

From their creation in 1993 Canadian REITs have grown and provided millions of Canadians with stable income from a pool of real estate investments. A REIT is both an investment categorization as well as a type of income trust with specific tax expectations. Plaza Retail Real Estate Investment Trust.

When the individual taxpayer is subject to a lower scheduled income tax rate. In general a REIT has the expectation to pay out most of their taxable income to their investors. Across Canada Canadian Apartment.

Granite REIT is a spin-off of Magna International which still continues to be its major tenant. 30 tax rate if shareholder owns 25 or more of the REITs stock. Download The Definitive Guide to Retirement Income.

Over the long term paying that 025 expense ratio is going to eat into your returns. Ad Potentially Access Up To A 20 Tax Deduction On Qualifying Reit Income. REITs voting stock and in the case of REIT dividends paid to a c orp or ati n esid tin C yprus r Eg pt m h5 f.

The growth was driven by a 252 increase in average rent and rental income from. In fact distributions received in a non-registered account are usually counted as a combination of normal income and capital gains and taxes can be applied accordingly. Then paying dividends to a shareholder who then gets the dividend tax credit.

Half of the capital gain or 50 will be taxable. Ad Have a 500000 portfolio. Plaza Retail REIT is a REIT stock within the retail category.

Thats 25 for every 10000 invested. Sure you get a monthly dividend through the ETF however. REITs typically pay quarterly dividends most Canadian REITs pay monthly.

It invests exclusively in properties within Canada with a 617 allocation to Atlantic Canada 169 allocation to Ontario 201 allocation to Quebec and only 13 allocated to Western Canada. Consequently REITs are tax neutral to. Taxpayers who hold Canadian dividend-paying stocks can be eligible for the dividend tax credit in Canada.

Reit Taxation A Canadian Guide

Reit Taxation A Canadian Guide

Smartcentres Reit Sru Un A Smart Reit For Income Investors Reverse The Crush Personal Finance Lessons Income Investing Investing Money

Reit Sectors From The Lens Of A Dividend Investor Seeking Alpha

Reits Canada Still Offers Tax Advantages For These Investments

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

Understanding The Reit Taxation Rules Novel Investor

A Short Lesson On Reit Taxation Intelligent Income By Simply Safe Dividends

The Reit Stuff How Reit Etfs Can Send Your Dividends Through The Roof Nasdaq

Passive Income 1 Top Reit For Steady Monthly Dividends

Introduction To Canadian Reits Seeking Alpha

Monthly Dividend Reits 5 Reliable Reits That Pay Every Month Reverse The Crush Dividend Stocks Dividend Income Investing

Finding The Reit Income Opportunity In 2020 Horizons Etfs

Top 3 Canadian Reits For 2020 And Why Riocan Is Not Part Of It Seeking Alpha

Dividend Income Report August 2020 Reverse The Crush Dividend Income Dividend Dividend Investing